Targeting the Social in ESG

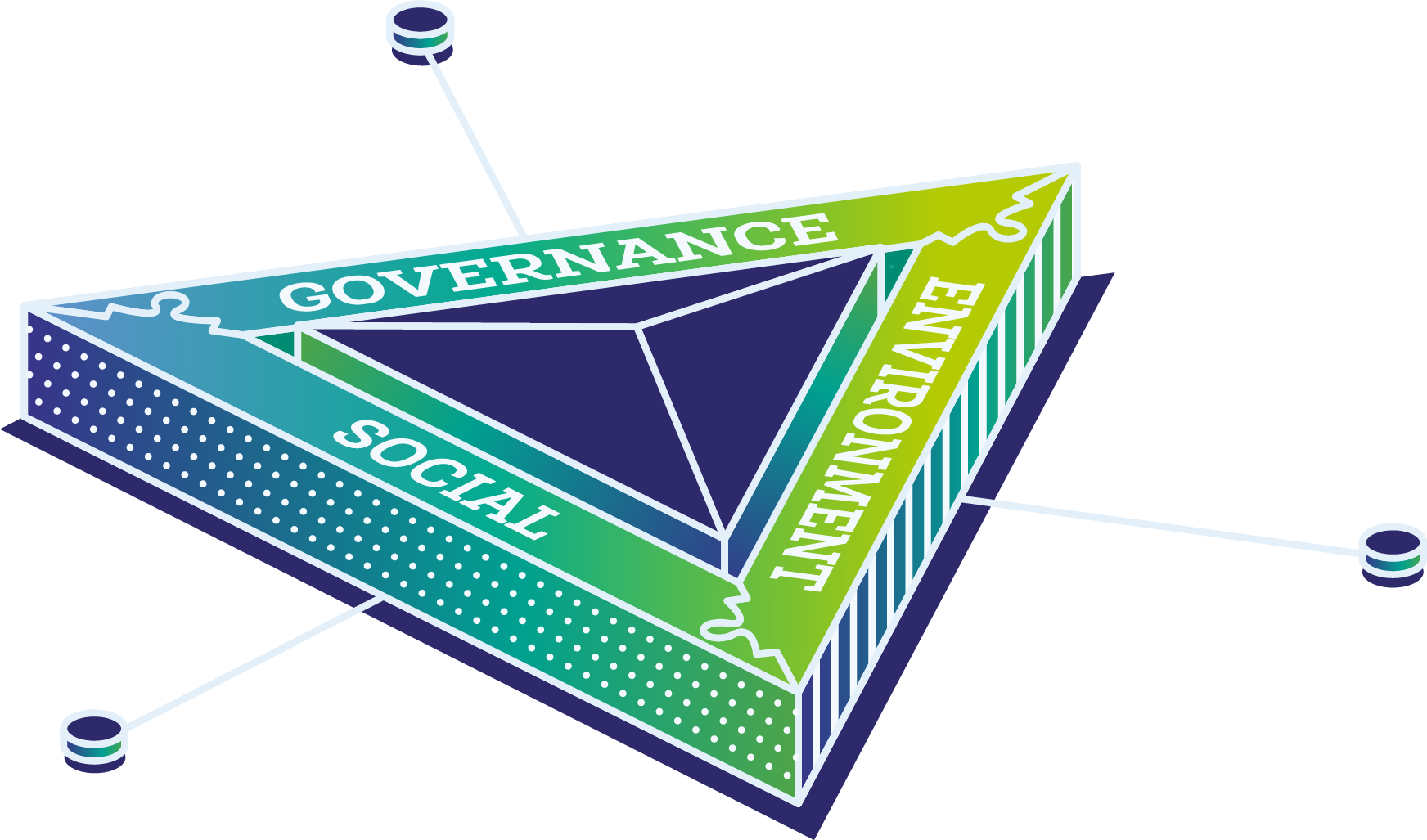

What is ESG?

ESG is often misunderstood or not understood in depth. It is commonly associated with ‘business and the environment’ (as well as being a growing concern in financial investment and the public sector) and is sometimes considered as meaning the same as ‘sustainability’ or ‘net zero’. These terms are sometimes used interchangeably (even though they differ in very important ways).

But while the three parts of ESG—Environmental, Social, and Governance—are distinct from one another, they are also interdependent.

In simple terms, ESG is a framework that is embedded into an organisation to create a paradigmatic shift towards a stakeholder-centric approach. The fundamental belief it represents is that ‘environment’ is only one pillar of three that determine the overall commitment of an organisation to sustainable outcomes that influence individuals, society and the planet.

Some examples of the issues that fall under each ESG pillar are given below:

Environmental

• Climate Change

• Decarbonisation

• Water pollution, wastage and scarcity

• Air pollution

• Deforestation

Social

• Mental health at work

• Diversity and Inclusion

• Relation to local communities

• Workplace culture

• Supply chain management

Governance

• Makeup of the board

• Strategy and goals

• Political ties and lobbying

• Choice of companies for tender

• Ethics and values

In this introductory article (the first part of a series) we focus on the ‘Social’ pillar.

The impact of ESG on our perception of 'good' companies

The three pillars of ESG: ENVIRONMENT, SOCIAL & GOVERNANCE

Over the last two decades, climate change, environmental concerns and sustainability have become major issues in public and corporate discourse. The imperative is clear: climate change is already upon us and having a major and growing impact on the lives we lead, so we must do something urgently.

Everyone—individuals, government and all organisations, private or public—has an obligation to try to mitigate, and in some cases reverse, developing problems. This is not just a ‘nice to have’ or the right thing for the planet and the people on it, it is fundamental to business success.

In his 2022 ‘Letter to CEOs’, which has become a keenly anticipated annual event, Larry Fink of Blackrock wrote,

“Most stakeholders—from shareholders, to employees, to customers, to communities, and regulators—now expect companies to play a role in decarbonizing the global economy. Few things will impact capital allocation decisions—and thereby the long-term value of your company—more than how effectively you navigate the global energy transition in the years ahead.” [1]

As head of a global investment management and financial services business, Fink has had one succinct message since 2020: "climate risk is investment risk". But of course, it is not just investment risk. All organisations, of whatever type, must make changes to what they are doing if they are to survive, and if we are to survive. The biggest risks do not therefore come from acting on sustainability, but from a failure to act. When a business chooses to ignore climate and sustainability or fails to adapt, its future is in peril. In this way, the environmental importance of ESG has broken like a wave over all of us.

The focus on environmental concerns has coincided with, and helped to drive, another fundamental change: in the same way as most would acknowledge that government should be a force for good rather than a necessary evil, so now the expectation is that all organisations act as forces for good and demonstrate how exactly they are doing that.

In other words, the tectonic plates of cultural expectations have shifted. This is partly generational: data currently available suggests that GenX are much more likely to remain liberal as they age than their forbears, and that they and their successors (Millennials, GenZ, etc.) want business to have a function beyond profit. [2]

Leaders and boards can find themselves caught in the crossfire of societal and employee expectations, and the need to achieve the fundamental objectives of the organisation, whether that is profit or something else.

How can they square the circle of succeeding on one without sacrificing the other, while at the same time remaining compliant with the law, regulations, KPIs and the fundamentals of good governance?

The good news is that it is becoming increasingly clear that a well-devised, focussed sustainability strategy and delivery plan can greatly improve profitability and create market advantage compared to competitors.

In this series of articles, we focus on how businesses can successfully address the key aspects of the ‘S’ in ESG, and how we at Cambridge Management Consulting can help you do this.

How to focus on the S in ESG

The changes to public expectations, and the challenge and opportunity of squaring the circle, extend inevitably to the ‘social’ side of ESG, which has previously received less comprehensive attention than its ‘E’ counterpart.

Notable examples of the ‘social’ side of ESG in action are the growing emphasis on the importance of diversity hiring and employee wellbeing, as well as on things like social impact. As with the ‘E’ side of ESG and the increase in appointments relating to sustainability, this has led to the creation in many organisations of the role of Head of Diversity, Equity & Inclusion (DE&I), or of ESG more broadly, and to the production of annual DE&I reports. It is a world in which no one wants to be left behind, and in which businesses and other organisations must display their credentials.

It is important to note that things are moving fast, and we have already seen significant progress on the social side of ESG. For example, many organisations have invested heavily in employee wellbeing programmes (including mental health), in mentoring, and in creating supportive platforms for traditionally under-represented groups. Furthermore, many are aware that greater diversity is good for profits.

This has led to some positive results, with many DE&I reports indicating rising ethnic and gender diversity. For example, organisations are also beginning to think harder about inclusive recruitment and selection processes: does this role really require a university degree; does the test we set disadvantage certain groups of applicants, etc.?

And, with some notable exceptions, conversations are being had with workforces about the balance between online, hybrid and in-office work. Similarly, in another direction, supply chains are being increasingly scrutinised for things like child labour, exploitation and poor working conditions.

Organisations are recognising that they need to have a positive impact on society and are taking action to realise that goal.

However, at the same time, there continue to be many significant issues. If we look as an example at the DE&I side of the ‘S’, DE&I officers regularly report feeling peripheral to their organisation and speak of a failure truly to embed DE&I, feeling almost as though the appointment of a DE&I officer tells management that it has discharged its duty. [3]

At the same time, Scott Keller’s work indicates that only 18% of executives in Fortune 500 companies believe their company gets recruitment of the most talented people right, and a recent survey found that two in five UK businesses do not collect data on the demographic composition of their workforce. [4] In another survey, only just over a half of respondents rated their recruitment and selection processes as ‘effective’ or ‘very effective’ in positively affecting diversity and inclusivity in their company’. [5]

Moreover, there is limited reporting on things like age and disability/SPLD (often difficult to do within legislative frameworks, but not impossible), and workplace returners (e.g., those who have taken time out of the workplace to fulfil caring/parenting roles). Even in relation to the commonly reported characteristics, data is rarely especially granular, or cross-segmented (e.g., class and gender), which is a further weakness. More female managers and CEOs is progress, but if they come predominantly from one socio-economic background or are mainly white and heterosexual, other cross-cutting aspects of diversity remain unaddressed.

This is only one aspect of the ‘S’ and demonstrates how quickly things are moving and how much of a challenge organisations face. It may not be long before ‘diversity-washing’ becomes as common a term as ‘greenwashing’ to signal real failures to achieve anything more than superficial change. [6]

No one wants to have to bring a damaged brand back from the brink, so many boards are beginning to share concerns about their performance in this area, and they are now trying to step up efforts.

How Cambridge MC can help your organisation with DE&I

Leaders and boards trying to grapple with all this would be forgiven for thinking that they are caught in a storm trying to get to an unclear destination with a spinning compass. But this does not need to be the case. At Cambridge Management Consulting we have developed a model that enables both a clear and holistic definition of the ‘S’ in ESG, and an effective and systematic approach to each element.

As the diagram indicates, at the core is organisational culture:

- How does the organisation see itself?

- What aspects of its culture need overhaul?

- What behaviours and attitudes does it embody?

- What is prioritised and how is that decided?

- How would someone describe the organisation (and brand) from within and outside?

- Where does it sit in its context – how does it differ culturally and reputationally from others in the same business area?

- Has any change occurred and, if so, what was its impact?

Redefining organisational culture from the inside out is a difficult, costly and not immediately impactful way for those organisations to make progress on the social side of ESG. What organisations can and must do is embed this into the wider strategy at C-Suite level, before looking at specific ways to implement the strategy.

What the sections in the diagram indicate is that a series of practical, individual and, to some extent compartmentalised, steps that can be taken initially to work towards specific goals. Each can be defined one at a time, keeping a watchful eye on the overall coherence and alignment with strategy.

It is crucial throughout to pay attention to what the data indicates in terms of strengths and weaknesses in relation to priorities. You cannot improve your diversity recruitment, for example, without understanding where specifically your talent pipeline is blocked and taking targeted action to address that. You can adopt any number of wellbeing schemes to address stress, burnout and retention issues, but if your office culture at a local level is toxic, you are destined to fail.

You can specify rules for your suppliers to follow, but if there is no formal scrutiny, you cannot be sure that the vision is being realised in practice. That does not mean that you cannot make a very positive and impactful start in these areas—it is key that you do this. In due course, though, it will need to be accompanied by other actions to deliver its maximum benefit. And you need to have a plan for that.

Key Takeaways

- There are few quick fixes, but taking a stepwise approach is likely to generate real results.

- Having a keen sense of the overall picture in relation to the wider organisational strategy is also key to begin to remove the silos that tend to prevail in many businesses.

- Such an approach is also much more likely to open the door to greater profitability/value creation, squaring that elusive circle, and allowing you to set the standard and pace for your peers.

- In the following series of articles, we will discuss each of the major categories and suggest some of the actions that are likely to be effective, based on an ever-growing body of research.

edenseven

If you are struggling with the ‘E’ in ESG, edenseven, Cambridge Management Consulting’s sustainability sister company, works with a range of organisations across differing sectors to support in the rapid decarbonisation of their operations and the services they provide to their customers.

Their proven record of delivery in the space shows that ESG offers a wealth of opportunities for companies to realise.

About the author

Dr Caroline Burt has worked in business, higher education and the public sector, and has many years of experience in recruitment and selection. She is an expert on diversity recruitment. She has transformed admissions at Pembroke College as Director of Admissions and produced the most diverse intake in the College’s history. This has been based on a data-driven approach and a collaborative working model. She also has executive education and experience in mentoring and leadership development and has developed an innovative leadership development programme for undergraduates.

As a non-executive director on two boards, she has been a member of Regulation and ARAC committees and chaired the Remuneration Committee of Qualifications Wales where she made reforms to the CEO succession plan and the Board Chair’s appraisal process. She currently serves on the Independent Welsh Pay Review Body (IWPRB), which is responsible for making recommendations on schoolteachers’ pay and conditions to the Welsh Government. She is an Associate Partner at Cambridge Management Consulting, with expertise on the people, recruitment and diversity side, and on higher education.

References

[1] https://www.blackrock.com/corporate/investor-relations/larry-fink-ceo-letter

[2] https://www.forbes.com/sites/michaelstone/2021/05/18/gen-z-they-crave-stability-and-trust-so-give-it-to-them/?sh=68389338594a; https://www.kornferry.com/insights/this-week-in-leadership/millennials-purpose-generation; https://slate.com/news-and-politics/2022/10/gen-x-politics-explained-republicans.html; https://www.ft.com/content/c361e372-769e-45cd-a063-f5c0a7767cf4

[3] https://knowledge.wharton.upenn.edu/article/elevate-diversity-equity-inclusion-work-organization/

[4] https://www.mckinsey.com/business-functions/people-and-organizational-performance/our-insights/attracting-and-retaining-the-right-talent; https://www.recruiter.co.uk/news/2021/06/staffing-firms-fail-report-staff-diversity-finds-joint-rec-and-apsco-report

[5] https://uk.news.yahoo.com/uk-jobs-recruitment-diversity-inclusion-targets-missed-153007321.html

[6]

https://www.viridor.co.uk/news-and-insights/wash-rinse-and-repeat-greenwashing-on-the-rise/;

https://www.businessinsider.com/diversity-washing-greenwashing-george-floyd-corporations-black-lives-matter-2021-1?r=US&IR=T

Contact - Africa

Subscribe to our Newsletter

Blog Subscribe

SHARE CONTENT